Am I a business entity. Corporate tax rate has also helped put US.

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Self-Employment Tax Rate.

. This rate consists of 124 for social security and 29 for Medicare taxes. The small business tax rate for the 2019 tax year is a flat 21 for a C-corporation and will remain so for the 2020 tax year. To summarize a personal holding company PHC is a C corporation in which.

Updated Corporation Tax Rates for FY 2019-20 AY 2020-21 The Finance Ministry has announced new corporate tax rates applicable from 1 st April 2019 onwards for certain types of corporations. Japan also slowly decreased its corporate tax rate from 42 in 2003 to 3062 in 2019. The Two-Tier Profits Tax Rates Regime effective from Year of Assessment 201819.

On average the effective small business tax rate is 198. The following are the new rates that are applicable. A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities.

Your company treats you as an independent contractor. What Is a Corporate Tax. The tax is imposed at a specific rate as per the provisions of the Income Tax Act 1961.

Base rate entity from the 201718 income year and onwards. A PHC must pay a corporate tax equal to 20. The tax is levied on undistributed PHC income.

Many countries impose such taxes at the national level and a similar tax may be imposed at state or local levels. Employment taxes can be complicated. Residency tests are applied as follows.

The corporate tax rate applies to your businesss taxable income which is your revenue minus expenses eg cost of goods sold. Residency Taxation in Indonesia is determined on the basis of residency. Headquarters of Inland Revenue Board Of Malaysia.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Tax Rate of Company. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate.

The company tax rates in Australia from 200102 to 202122. Base rate entity company tax. For Dividend income of a foreign person NRI from shares of an Indian company purchased in foreign currency TDS rates of 20 sec 195 and Tax rate of 20 sec 115E115A are net tax rate or some cess and or surcharge would apply.

Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes. Federal revenues as a share of the economy gross domestic product or GDP stood at 20 percent in 2000. The maximum tax rate was 35.

The Tax forms and Calculators Are Listed by Tax Year. Small business entity for the 201516 and 201617 income years. Article compiles Normal Income Tax rates for Individual HUF Special Income Tax Rate for Individual and HUFs Normal Income Tax Rate.

The law sets the self-employment tax rate as a percentage of your net earnings from self-employment. RSA providers other than life insurance providers. The full company tax rate of 30 applies to all companies that are not eligible for the lower company tax rate.

Dividend Tax rate 2019 Integrated Corporate Tax rate. For assessment year 2022-23 and 2023-24. Prior to the Tax Cuts and Jobs Act there were taxable income brackets.

A company with a market value of 23 billion moved its headquarters from Milwaukee Wisconsin to Ireland in 2016. Rate Ordinary class of taxable income. Additional Medicare Tax applies to self-employment income above a threshold.

It argued that the increasing global economic significance of digital products and services requires an update to taxation rules to prevent companies from shifting profits to jurisdictions with a lower corporate tax. The rate increased as of 2013 with the passage of the American Taxpayer Relief Act of 2012. There are seven tax brackets for most ordinary income for the 2021 tax year.

From 2003 to 2012 the tax rate was 15. In this Article we updates about the normal and Special Income tax rates applicable to different types of taxpayers for Financial Year 2021-22 and 2022-23 ie. In Hong Kong.

1 The type of taxing unit determines which truth-in-taxation steps apply. Company Financial year ended between 1st April until 30th Dec 2018 No extension is permitted. A corporate tax is a total tax applied to the profits of a company.

The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017. I received a Form 1099-MISC from the company I work for here in Nevada. Flat Corporate Tax Rate.

10 12 22 24 32 35 and 37. Indonesian Tax Guide 2019-2020 7 General Indonesian Tax Provisions Law Number 6 of 1983 regarding General Procedures and Provisions for Taxation as most recently amended by Law Number 16 of 2009. Your tax bracket depends on your taxable income and your filing status.

Not-for-profit companies that are base rate entities. Many businesses hire a payroll company to manage their payroll tax liabilities and file their tax forms on their behalf. Company with paid up capital not more than RM25 million.

In 2019 the OECD an intergovernmental association of mostly rich countries began proposing a global minimum corporate tax rate. Starting 2018-2019 tax year there is no Commerce Tax filing requirement for the businesses with the Nevada gross revenue of 4000000 or less during the taxable year. Eligibility for the lower company tax rate depends on whether you are a.

HK fiscal year is from 1st April 2018 to 31st March 2019 normally PTR will be issued on the 1st working day in April 2019. Businesses on a more level playing field with. Back Taxes For Previous Year Tax Returns 2020 2019 2018 2017 etc.

Oecd Corporate Tax Rate Update Tax Executive

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

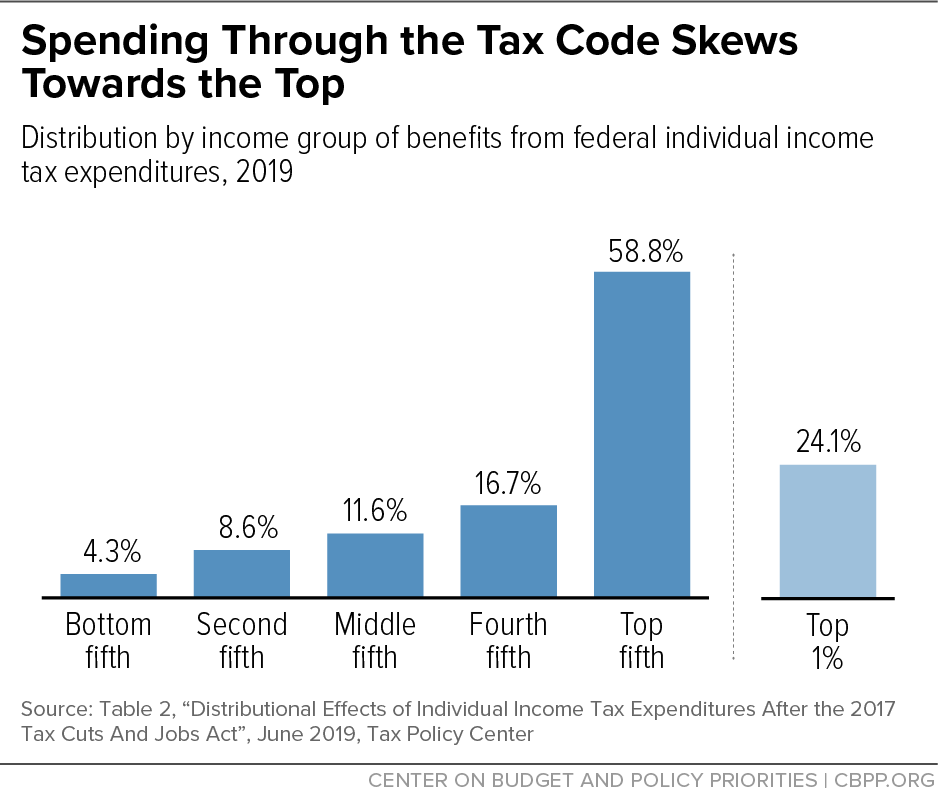

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

Business Taxes Page 46 Of 159 Tax Foundation

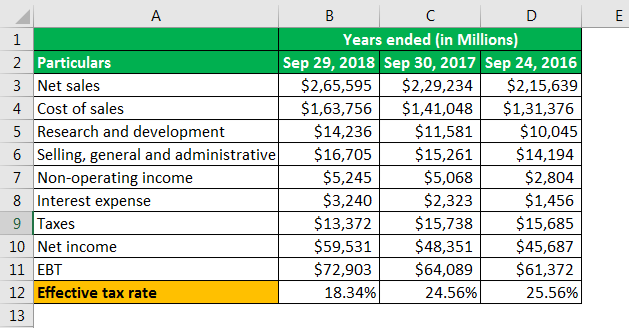

Effective Tax Rate Definition Formula How To Calculate

State Corporate Income Tax Rates And Brackets Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Average Tax Rate Definition Taxedu Tax Foundation

2018 Corporate Tax Rates Birch Accounting Tax Services Ltd

The Corporate Minimum Tax Could Hit These Ultra Profitable Companies The Washington Post

Effective Tax Rate Formula And Calculation Example

The Corporate Minimum Tax Could Hit These Ultra Profitable Companies The Washington Post

Tax Brackets 2019 Tax Brackets Bracket Tax

How Much Does A Small Business Pay In Taxes